Puig, a global premium beauty player with a curated portfolio of Love Brands, reached €2.2 billion in sales in the first half of 2024, up 9.6% compared to the same period last year. Puig also grew its global selective fragrances Value Market Share (VMS) to 11.3% - a 60bps improvement when compared to June 2023. The company achieved an adjusted EBITDA of €410 million, an increase of 7.4%, reaching an adjusted EBITDA margin of 18.9%. Adjusted net income grew 4.8% in the first half to €238 million, equivalent to 11% of revenues.

Marc Puig, Chairman and CEO of Puig, said, "We delivered a strong first half of the year with sales growth of 9.6%, outperforming the premium beauty market. We are particulary pleased with our performance across our core geographies despite a challenging economic environment market by geopolitical tensions. Our continued focus on the premium beauty sector, as well as the strength and desirability of our brands alongside disciplined financial execution have ensured that our profitability remains compelling. While our fragrances and fashion business remains our largest segment, we further diversified into skincare - our fastest growing business segment during the first half - with a strong organic growth component and a strategic brand acquisition.

The strength of these results continues to demonstrate the sucess of four strategic choices and gives us the confidence to maintain the medium-term guidance we provided at our IPO in May this year.

We are proud of the sucess of our IPO, which marked a significant milestone for our company and reflects the trust and confidence in Puig. We want to continue to build on this momentum as we look towards the future".

2024 Half-Year net revenues performancePuig's strong brand portfolio continues to drive growth ahead of the premium beauty market, with our Prestige brands contributing meaningfully to this growth. Net revenues grew 9.6% year on year, primarily driven by 8.5% like-for-like (LFL) growth. The acquisition of Dr. Barbara Sturm during the first quarter of the year, which the company is integrating, had a €28 million or 1.4% positive impact on net revenues. Exchange rate effects had a negative €6 million, or (0.3%) impact, mainly driven by exposure to some emerging markets, offset in part by the British pound.

Fragrances and fashion remains Puig's largest and most profitable business segment, growing by 10.7% on both a reported and constant perimeter basis, generating €1.6 billion of net revenues in H1 2024, and representing 73% of total sales for the period.

Growth was driven primarily by consistent performances across the Prestige portfolio complemented by new product launches and range extensions. This drove Puig's global Value Market Share (VMS) in selective fragrances to 11.3%, further solidifying its leadership in key regions, including North America and Europe.

A noteworthy highlight is Jean Paul Gaultier's exceptional performance, owing to its established market position and commitment to product innovation, capturing new consumers, as seen with the launch of La Belle, Le Beau and Scandal Absolu. Jean Paul Gaultier joined Carolina Herrera and Rabanne in the top 10 ranking fragrances worldwide for the first time. It is also significant that Carolina Herrera's Good Girl maintained its #2 feminine fragrance ranking worldwide. Charlotte Tilbury launched its first fragrance collection, becoming a tri-axis brand.

Puig has also continued to develop its unique Niche fragrance offerings, with a series of launches at Penhaligon's, Byredo, Dries Van Noten and L'Artisan Parfumeur.

Skincare: Puig's fastest-growing business segmentSkincare continues to be Puig's fastest-growing business segment with revenues reaching €256 million, marking a 25.2% increase on a reported basis (+11.6% on a constant perimeter basis). The business segment accounts for 12% of the company's total sales, highlighting its growing importance within Puig's portfolio. The skincare segment achieved growth across categories, including Dermo-Cosmetics brand Uriage - which experienced strong double-digit growth - and Prestige brand Charlotte Tilbury which introduced innovative product offerings within its growing skincare business.

Momentum in the skincare business segment was bolstered by the acquisition of Dr. Barbara Sturm in Q1 2024, with the addition of a Niche brand to the skincare portfolio. The brand's diverse range of exclusive skincare products resonates well with consumers across regions. The acquisition is testament to growth potential of the skincare business segment and consolidates Puig's commitment to building and scaling a comprehensive and diversified skincare portfolio spanning Dermo-Cosmetics, Prestige, Niche and Skincare Wellness.

Makeup: Charlotte Tilbury takes a leadership position in the US marketThe makeup business segment recorded revenues of €334 million for H1 2024, reflecting a 1.8% decline compared to H1 2023, and contributing 15% to total sales in the period. This contraction comes against the backdrop of a more challenging environment.

While Puig brands have limited exposure to the Asian market, Christian Louboutin Beauty was impacted by lower performance in the region. The largest contributor to the business segment, Charlotte Tilbury, had a softer sell-in performance, but maintained a strong sell-out growth that helped it gain market share in the US, where it has now become #2 makeup brand and has continued to maintain its #1 leadership position in the UK, while maintaining a stable profitability level.

EMEA

EMEAEMEA remains Puig's largest market generating 53% of net revenues. The region achieved growth of 12.1% on a reported basis and 10.5% on a constant perimeter basis, driven by strong demand for Puig's brands and successful new product launches.

Strategic investments in the region - such as the opening of the new Puig Tower in Barcelona including an Innovation Center; and the expansion of the London offices - have further strengthened Puig's operational capabilities in the region and are part of Puig's broader commitment to enhance its presence in EMEA, remaining well-positioned to capitalize on regional growth opportunities.

AmericasIn the Americas, Puig reported strong revenues growth of 8.6% on a reported basis and 7.0% on a constant perimeter basis. The US market was a standout performer, delivering robust double-digit growth driven by the success of the fragrances and fashion and skincare business segments. The company also continued to build on its leadership position in fragrance in Latin America, although the first half growth has been moderate due to fluctuations in foreign exchange, in particular in Argentina. Puig remains focused on expanding its footprint in the Americas, evidenced by the opening of new US offices in the Rockefeller Center in New York.

Asia-PacificThe APAC region, while smaller in terms of revenue contribution (9% of net revenues), continues to be a strategic focus for Puig. The region faced a challenging market environment, particularly in China where economic conditions impacted consumer spending.

Puig's Niche fragrance business gained market share in the region, with the company delivering mildly positive growth of 0.7% both on a reported and constant perimeter basis.

Despite the external challenges, Puig continued to adopt a selective approach in APAC allowing it to maintain steady progress. The establishment of new subsidiaries in Japan, Korea and India underscores Puig's long-term commitment to the region, positioning the company for future growth as economic conditions stabilize.

ESG commitmentsPuig continues to advance its 2030 ESG Agenda, with a strong focus on sustainability and responsible business practices. The company's net-zero target, approved by the Science Based Targets initiative (SBZi), reflects its commitment to significantly reducing greenhouse gas emissions by 90% by 2050. Puig's sustainability efforts have also been recognized on CDP's A list for Climate and commendable score of 20.7 (9

th out of 105) by Sustainalytics in the Household Products industry.

These achievements underscore Puig's commitment to integrating sustainability into every aspect of its operations, from product development to supply chain management. The company's ongoing investments in sustainable practices are designed to ensure that it remains at the forefront of environment stewardship in the beauty and fashion industry.

Gross profit margins improved to 75.8% by 70-basis points compared to the first half of last year, driven by continued premiumization and increased desirability of the company's Love brands, coupled with efficient cost management and operating leverage.

The company achieved an adjusted EBITDA margin of 18.9%, slightly below H1 2023 mainly driven by an increase in advertising and promotion during the first half of the year as planned to maintain desirability in Puig's Love Brands and support new product launches. While A&P reached 31.5% in H1 2024 (vs. 29.5% in 2023), Puig's P&L is managed on an annual basis with these costs expected to smoothen out over the remainder of the year, Puig confirms guidance of stable margin for FY2024 in line with the adjusted EBITDA margin levels in 2023.

Operating profit increased 3% to €313 million, while the operating margin fell slightly to 14.4% driven primarily by the increase in A&P.

Puig managed to maintain its double-digit adjusted net profit margin, reaching 11.0% or €238 million (+4.8% YoY) mostly driven by flow through from the company's operating profit.

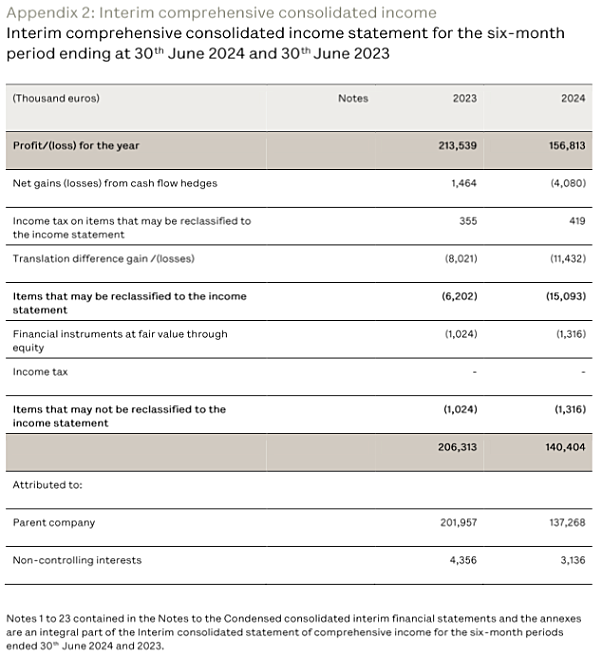

Reported net profit was down (27%) year-on-year, mostly impacted by one-off IPO costs, M&A expenses and other adjustments, which net of taxes amounted to €84 million, the largest of these adjustments was an extraordinary IPO award given to all Puig employees amounting in total to €94 million in cash bonuses.

Adjusted earnings per share amounted to €0.46.

Operating profit in the fragrances and fashion business segment increased 6.3% to €294 million thanks to its scale and competitive positioning, despite recent increase in A&P spend to support the brand portfolio.

The makeup operating margin decreased by 250 basis points due to the performance of Christian Louboutin and high A&P investments to support new product launches.

Skincare operating profit was stable at €18 million with a slight decrease in margin. The business segment is scaling and expected to benefit from operating leverage as recent acquisitions grow to scale, and following the complete integration of Dr. Barbara Sturm (which had a marginal dilutive impact as planned).

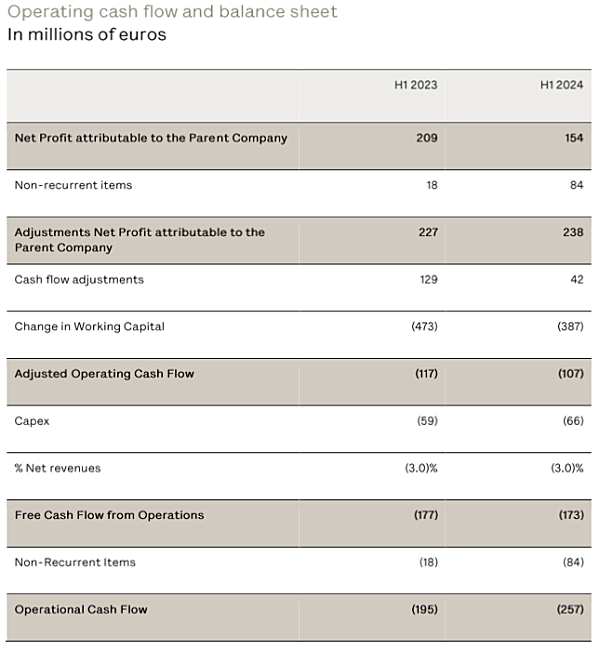

Operating cash flow improved to negative €107 million, driven by a lower increase in working capital. A cash outflow is typical given the yearly cyclicality of the business which requires more working capital in the first half of the year to fulfil the higher demand from the second half of the year.

Operational cash flow totaling an outflow of €257 million fell in comparison to H1 2023 due to non-recurrent IPO related cash impacts.

Net financial leverage stood at €1,520 million or 1.7x LTM adjusted EBITDA as of June 2024, in line with medium-term leverage target (below 2.0x Net debt/adjusted EBITDA).

Liabilities from business combinations improved from €2.4 billion at December 2023 to €1.6 billion on account of the acceleration of put/call options held by some minority partners, offset by a slight increase from recording a liability for the remaining stake of Dr. Barbara Sturm not owned by Puig.

Subsequently, on July 25th, Puig executed a call option for an incremental minority interest in Charlotte Tilbury amounting to €215m. With this additional stake in Charlotte Tilbury, Puig directly controls 78.5% ot the brand.

Dividends of €184 million were paid to shareholders in relation to the results for the fiscal year 2023.

About PuigPuig is a home of Love Brand, within a family company, that furthers wellness, confidence and self-expression while leaving a better world. Since 1914, our company's entrepreneurial spirit, creativity and passion for innovation have made Puig a global leader in the premium beauty industry. Present in the fragrances and fashion, makeup and skincare business segments, our house of Love Brands generates engagement through great storytelling that connects with people's emotions and is reinforced by a powerful ecosystem of founders. Puig portfolio includes our brands Rabanne, Carolina Herrera, Charlotte Tilbury, Jean Paul Gaultier, Nina Ricci, Dries Van Noten, Byredo, Penhaligon's, L'Artisan Parfumeur, Uriage, Apivita, Dr. Barbara Sturm, Kama Ayurveda and Loto del Sur as well as the beauty licenses of Christian Louboutin, Banderas and Adolfo Dominguez, among others.

At Puig we honor the values and principles put in place by three generations of family leadership. Today we continue to build on that legacy, through conscious commitments in our ESG Agenda (environmental, social and governance) aligned with the UN Sustainable Development Goals. In 2023, Puig recorded net revenues of €4,304 million. Puig sells its products in more than 150 countries and has offices in 32 of them.

Appendices

Disclaimer

DisclaimerThis document has been prepared by Puig Brands, S.A. (the "Company" and together with its subsidiaries, the "Group") for the sole purpose expressed herein and neither this document nor the information contained herein, can be used, disclosed, or published by third parties for other purposes without the prior written consent of the Company.

Neither the Company, nor other companies of the Group, will assume any responsibility, whether for negligence or other reason, for any damage or loss arising from any use of this document or the information contained therein. In particular, no investment decision on the Company's shares, securities or other financial instruments of the Company linked to them shall be taken on the basis of this documents and the information contained herein.

This document and the information contained herein should not be interpreted as an offer or invitation to acquire, subscribe, buy, sell, or exchange shares or securities of the Company or financial instruments referenced to or which underlying is shares or securities of the Company. It should also not be considered a solicitation of an offer for such activities, nor a recommendation or advice regarding shares or securities issued by the Company or financial instruments referenced to or which underlying is shares or securities of the Company.

The securities of the Company have not been registered under the United States Securities Act of 1933, and cannot be or will not be offered or sold in the United States, except in compliance with an effective registration statement or under a valid exemption from registration requirements. Likewise, these securities cannot be offered or sold in other jurisdictions except in compliance with applicable laws and regulations of those jurisdictions.

Forward - Looking StatementsThe information in this document may include forward-looking statements, which are based on current expectations, projections and assumptions about future events. These forward-looking statements include all matters that are not historical facts. The words "believe", "expect", "anticipate", "intends", "estimate", "forecast", "project", "plan", "will", "may", "should", "target", and similar expressions identify forward-looking statements. These forward-looking statements, as well as those included in any other information discussed in this document, are subject to known or unknown risks, uncertainties and assumptions about the Group and its operations, including, among other things, the development of its business, its growth plan and targets, trends in its industry, economic and demographic trends, and the Group's future capital expenditures and acquisitions. In light of these risks, uncertainties and assumptions, which may be beyond the Group's control, the events in the forward-looking statements may not occur and actual results, performance or achievements may materially differ from any future results, performance or achievements that may be expressed or implied in this document.

Alternative Performance Measures and Non-IFRS InformationThis document includes financial information prepared by the Company under the International Financial Reporting Standards ("IFRS") adopted by the European Union, as well as certain non-IFRS consolidated financial measures of the Group derived from (or based on) its accounting records, and which it regards as alternative performance measures ("APMs") for the purposes of Commission Delegated Regulation (EU) 2019/979 of March 14, 2019 and as defined in the European Securities and Market Authority Guidelines ("ESMA") on Alternative Performance Measures dated October 5, 2015. Other companies may calculate such financial information differently or may use such measures for different purposes than the Company does, limiting the usefulness of such measures as comparative measures. These measures should not be considered as alternatives to measures derived in accordance with IFRS, have limited use as analytical tools, shoul not be considered in isolation and, may not be indicative of the Company's results of operations. Recipients should not place undue reliance on this information.